Generational Wealth For Gen Z

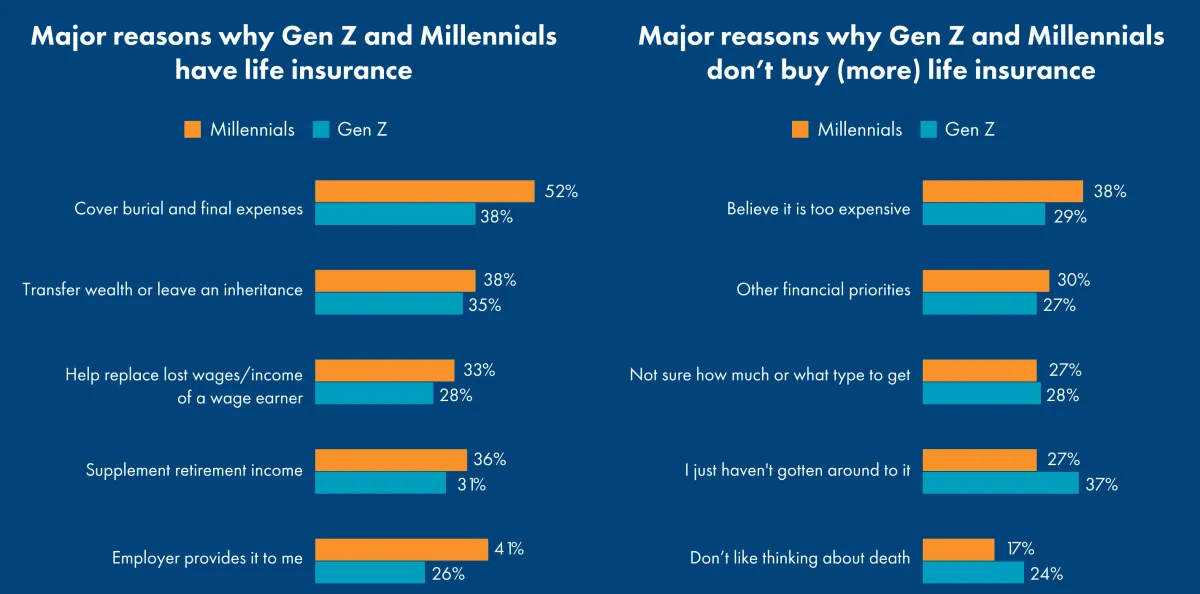

Figure 1

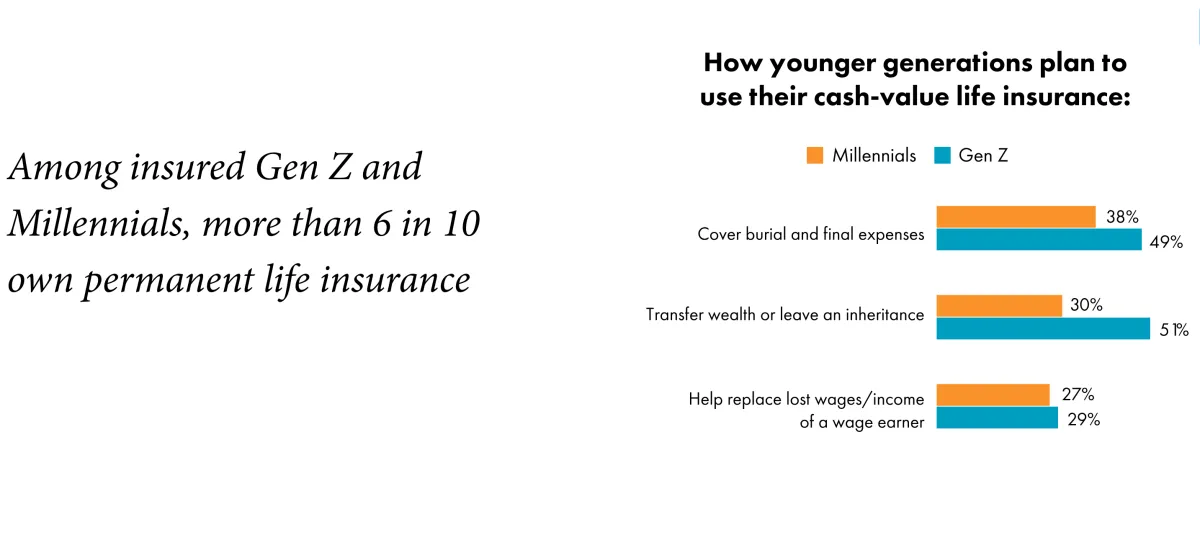

Only ~49% of Gen Z has life insurance. However, for those that do own life insurance, cash value life insurance (IULs and whole life insurance) is the most popular. This is likely because Gen Z wants life insurance that they will benefit from while they are alive.

Figure 2

The major misconceptions for why Gen Z does not own life insurance are the belief that it is too expensive and that it does not lend itself to financial power. Indexed universal life insurance is most often bought because of its superior death benefit range and its supplemental retirement income.

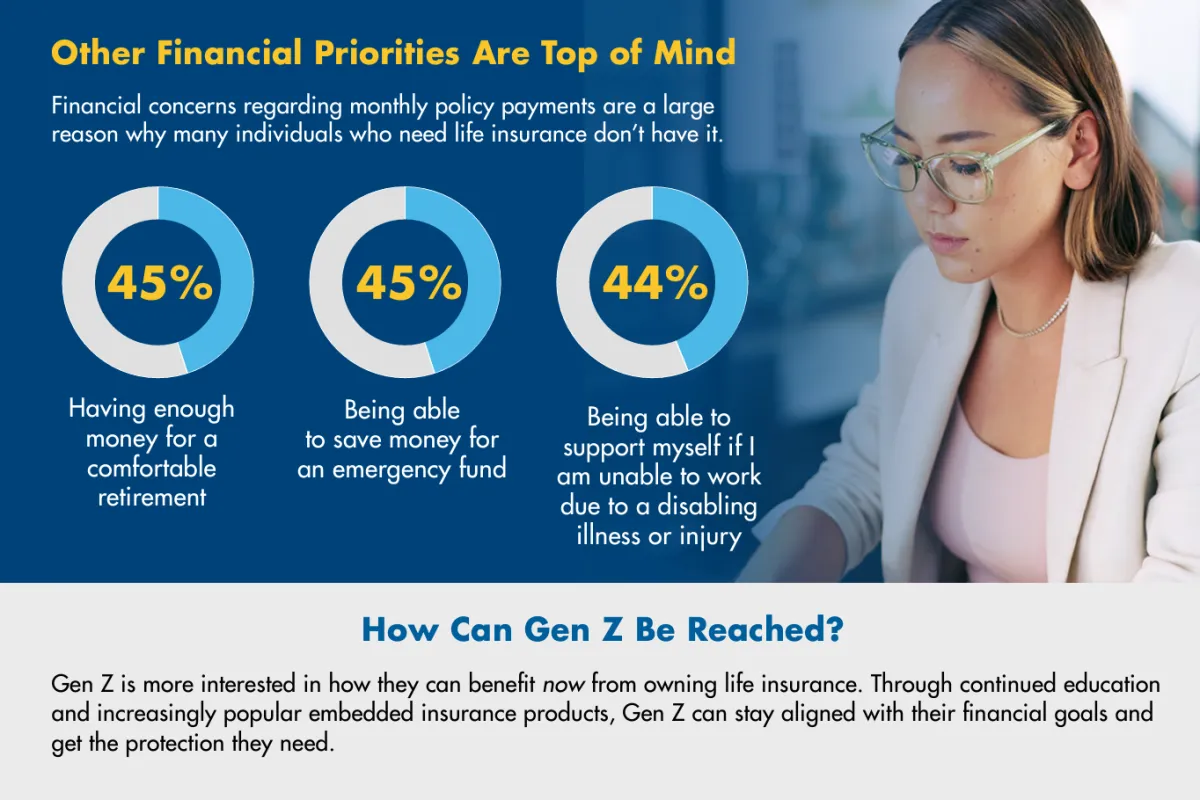

Figure 3

All of Gen Z's most common financial concerns regarding life insurance are serviced by indexed universal life insurance. For example, retirement income, an emergency fund, and disability income is all encapsulated in an iul product, making it the quintessential product to serve Gen Z.

Figure 1

Figure 2

Figure 3

Here's What People Say About Us

ADWC is always thankful for our amazing clients

I've learned that an IUL is a useful financial instrument where I can actively save money while simultaneously setting myself up for long-term financial gains...

Frederick G.

You are the best financial advisor I could ever ask for!

Sherry I.

Thank you for being thorough throughout the whole process.

Luana A.

(817) 968-3381

Phone Number

E-mail address

AD WOOD CONSULTING

Ephesians 3:20

Philippians 2:13

Email: [email protected]

Phone Number: +1 (817) 968-3381

Website: www.adwoodconsulting.us

©Copyright | AD Wood Consulting LLC | All Rights Reserved